About five years ago I found out about Girod Street Cemetery in New Orleans. It was the first mainly Protestant cemetery in mostly Catholic New Orleans, started in 1822 by the Episcopal church which eventually became Christ Church Cathedral. The Wikipedia article about the cemetery has some great history, much of which seems chaotic. In 1833 there was a big cholera outbreak in New Orleans and the cemetery became a dumping ground for bodies. It was a mixed race cemetery, so there were tons of graves of black people, slaves, and former slaves. Because it was New Orleans with its high water table and frequent flooding, the graves were above ground, sometimes in structures six tombs high. Over time the cemetery suffered from neglect and by the 1940’s was in really bad shape, at which time it was decided to close the cemetery and redevelop the land. Families were asked to make arrangements to move the remains of their relatives, but I don’t know how many people did that. Ultimately a contract was awarded to another cemetery to haul everybody off and rebury them, but very little provision seems to have been made for preserving tombstones or keeping everyone straight. In 1957, just before the cemetery was finally closed, a Life magazine photographer took a bunch of eerie and horrific pictures of overgrown graves, broken into, with coffins spilling out. Google has a lot of those photos in a collection that allows you to start a slideshow of about fifty pictures. There is also a great blog page with some of those pictures and more history that is definitely worth seeing. I don’t think the photos were ever published in the magazine.

Author: Ted

The Brunsons, Part 2

It was neat finding out that my great grandfather, Roy Brunson, had a sister and then being able to track down some of her descendants. But also at some point in the last few years, someone had gone into Family Search and added some ancestors for Roy’s parents and beyond. Roy’s father was known only as J. A. Brunson everywhere I found him. I found a Josiah A. Brunson in Mississippi, so I added that name, but I wasn’t confident about it. With the recent updates J. A. now had parents, Joseph Brunson and Elizabeth J. Young. For a while Elizabeth was only listed as Elizabeth Brunson, because her maiden name wasn’t known. Eric pointed out that Elizabeth Young’s brother was Hiram Casey Young, a confederate colonel and 4-term United States Congressman after the war, representing Memphis, Tennessee. Today a Congressman’s district has 710,000 people on average. Back then the number was 123,000, which is less than the number of people in one of Georgia’s 56 state senate districts. He represented Tennessee’s 10th Congressional District, but today Tennesssee only has 9 districts. Even though Casey wasn’t a direct ancestor, he would be my 3rd great granduncle. But I warned Eric that the Brunson-Young connection couldn’t be trusted 100% since it was entered fairly recently and I don’t know what supporting evidence was offered. In fact, Family Search showed that Casey had one sister named Elizabeth and another named Eliza, both with different birth years, husbands and children, which seemed a little unlikely, especially since Young is a pretty common last name and Elizabeth such a common first name. So anybody could attach an Elizabeth Young to this prominent family of a congressman. Then an interesting piece of evidence came up from the website, findagrave.com which tries to index and photograph all the tombstones in the country. Here is findagrave’s picture of Congressman Hiram Casey Young’s tombstone from Elmwood Cemetery in Memphis, which is amazingly simple, without his full name, the fact that he was in Congress, or even birth and death year, just “Casey Young” and Confederate flags:

The Brunsons, Part 1

Mom’s mother’s maiden name was Helen Brunson. Helen’s father, Roy Brunson, was shot and killed at work in Memphis while the rest of the family was in Birmingham in 1935, which was after Helen was married but before Mom was ever born. That was something I discovered when I found Roy’s death certificate online. Mom said she didn’t know about that, but I think Uncle Joe did. I was able to find Roy as a toddler in the 1880 census, living with his parents, J. A. and M. E. Brunson (they were even listed this way on their marriage license, but Roy’s death certificate listed his mother as Mary Steverson, which was close enough to find out that she was Mary Stevens, and find her parents), his brother Cecil, and his sisters Ss. E. and M. E. in Marshall County in the northwestern corner of Mississippi. It was hard to find out much else about that family. Cecil never shows up again in any records and I didn’t even know the names of his sisters. Women are hard to track down since they tend to change their last names when they get married. It was made more difficult because nearly the entire 1890 census was destroyed before it could be microfilmed. Then by the 1900 census Roy had married Velma McCord (they show 0 years married on the census) and they were living in Corinth, Mississippi, where Velma was from. That was about as far back as I could go with Brunsons back in 2014-2016 when I was doing most of my research. I did better with most other branches of the family.

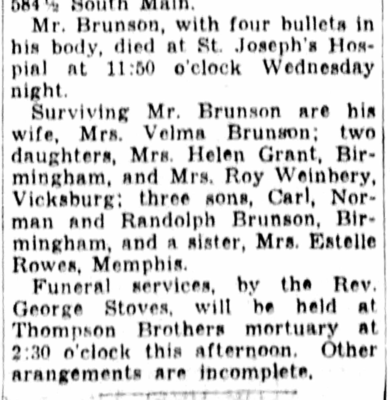

The nice thing about Family Search is it is collaborative, like Wikipedia, so family trees are all public (living people are not public) and can be added onto by anyone and, sometimes messed up or fixed by anyone. Lately Eric has been doing some research so he sent me a text message this weekend asking if I knew that my great grandfather had been shot to death in Memphis. He sent me the death certificate, which I had found before, and a partial newspaper clipping that I had never seen:

I Bond Interest

I bought an I Series savings bond last year and then another one this year. Since they are indexed to inflation, they have been earning a lot, though ultimately you gain nothing in purchasing power. The rules for I bonds can be pretty complex, like anything involving the federal government. The bonds earn interest every month, but it seemed very odd that both of my bonds, bought 3 months apart and earning different interest rates, were worth exactly the same amount of $10,236.00 (both purchased originally for $10,000). One part of it is that the amount the US Treasury tells you is the value does not reflect the last 3 months of interest since you forfeit 3 months of interest if you redeem the bonds before 5 years (and you can’t redeem them at all the first year, so I guess they are worth nothing right now). I also thought it was odd that the bond value each month has always been to a whole dollar amount, though since my principle was a very round number of $10,000, maybe that isn’t entirely unlikely. However today I found out more about how they calculate the actual monthly interest and decided to make a spreadsheet to try to keep up with it instead of just checking in with US Treasury. I like that it is all based on rules and ultimately I was able to replicate Treasury’s numbers. It helps that I found a wiki page at Bogleheads that explained it, but I still had to do the calculations myself before I could really see what was happening. The really weird part of it is that Treasury calculates interest on any size bond as if it is a bunch of individual $25 bonds. Then they round off the interest earned on the $25 bond to the nearest penny. So if you were to earn 1.73% interest on $10,000 you might expect to end up with $10,173. But because a $25 bond would be worth $25.43, you earn as much as 400 $25 bonds, or 400 * $25.43 = $10,172. It’s only $1, but if you are trying to verify the numbers it might throw you. Since I have 400 $25 bonds and the interest on those $25 bonds is rounded to the penny, the value of my bonds will not only always be to the nearest dollar, but the nearest $4 since 400 * $0.01 = $4.00. Also, while the bonds earn interest every month, the interest is compounded every six months. So they calculate the interest on the original amount for 5 months before adjusting the principle on the sixth month (which is also when the interest rate changes). That is a little tricky too.

The other part is how to take out the most recent 3 months of interest. I was trying to think of a formula that would do it, but would be smart enough to be able to accommodate when the interest rate changes during that 3 months. But since I was calculating the value for every month anyway, it was easy to just say that today’s reduced value is the same as the full value from 3 months ago. Really easy. Once I did all of that I was able to regenerate the numbers, but a lot depends on the roundoff of the $25 bond.

The interest rate itself is always rounded to 2 decimal places and is based on the CPI-U numbers published by the Bureau of Labor Statistics. Since BLS publishes the inflation rate monthly and the last one before the bond rates change comes a couple of weeks before you can actually predict the rate that Treasury will use. The unknown part of Treasury’s rate announcement is the fixed rate that Treasury gives, but for years they have made that really easy by having a fixed rate of 0%. With interest rates still pretty low right now, but inflation very high, I thought Treasury might make the fixed rate negative, but they haven’t done that. Even during deflation when inflation is negative, the savings bonds never lose value and the earnings rate doesn’t drop below 0%.

There are other bonds that Treasury sells on the market called TIPS which are inflation adjusted, but because inflation is so high the yield determined at auction has been negative lately so that the true yield ends up below the inflation rate. TIPS are weird too because they only pay a dividend of the auction rate while the principle value of the bond varies with inflation, so the dividend you receive would be at least 1/8% (not negative since then you would have to send them money) and they apply the negative portion by reducing the principle. So you don’t get barely any dividend and the principle ends up not keeping up with inflation. The downside of the I bonds is you can only buy $10,000 in a calendar year.

Tire Repair Kit

When I bought my Ford Escape in August 2020, it did not include a spare tire, not even one of the miniature tires. Instead it included an electric air pump that you plug into the lighter socket, called the “Tire Sealant and Inflator Kit” or “temporary mobility kit”. It includes a switch that can activate a canister of latex to repair a tire if it had a leak, but this would be ineffective if the hole was too large or if you had a blowout. The latex fix was temporary and ideally would get you someplace that could do a better fix. It seems like I read somewhere that once you used the latex, the tire would never be good again and would have to be replaced, but the owner’s manual doesn’t say that, just that you have to replace the valve stem and tire pressure monitor for that tire. The advantage of this system is it is lightweight, compact, and cheap, reducing weight of the vehicle, increasing mileage, and increasing space in the car. For the hybrid the tire well is also where they decided to put the 12V car battery, so no way to just get a tire. It is also easier to operate than using a jack, removing lug nuts, and replacing a tire. However, the latex canister expires in 4 years and has to be replaced. The disadvantage of this system is you can’t go that far or fast once you do the repair (like with the mini tires) and doesn’t work if damage is severe. The mini tire was a compromise compared to having a full size tire, and this inflator is a further compromise.

In the previous couple of weeks I had driven the car to Washington, DC without any incident, but I was driving a few miles to Jeb’s house when the car alerted me about low tire pressure in my right front tire. The car has a display for pressure in the tires and the other tires were all okay, so this wasn’t just a seasonal thing. The pressure was 25 psi and the other tires were around 30-32 psi. Very quickly as I continued to drive it dropped to 21 psi and I thought I might not make it to Jeb’s. As I found a place to pull over it was down to 18. As I parked it was 16 psi. I got out and could hear air escaping the tire and could even feel the air coming out of the tread. Time to try out the kit!